Despite already increasing prices for the iPhone 17 Pro and iPhone 17 Pro Max this year, Apple is facing a new and growing challenge as global DRAM shortages intensify. Recent reports indicate that the company is now paying up to 230% more for LPDDR5X memory, a critical component that could significantly impact production costs and future pricing strategies.

LPDDR5X RAM Prices Skyrocket

According to reports from industry sources and the blog yeux1122, the cost of 12GB LPDDR5X RAM surged dramatically throughout 2025. Early in the year, Apple reportedly paid around $25–30 per chip, but by late 2025 prices had climbed to approximately $70 per unit.

This sharp increase reflects mounting pressure within the global memory market, which is experiencing supply constraints driven by growing demand for AI-capable devices, data centers, and next-generation smartphones. Even with Apple’s reputation for world-class supply chain management, such extreme cost inflation is difficult to absorb without consequences.

Supplier Contracts Near Expiration

Adding to the challenge, sources reveal that Apple’s long-term supply contracts with major memory partners Samsung Electronics and SK Hynix are set to expire in January 2026. This timing places Apple in a vulnerable negotiating position, especially considering Samsung currently supplies an estimated 60–70% of Apple’s DRAM needs.

With limited alternative suppliers capable of matching the scale and performance requirements Apple demands, the company may have little leverage to avoid higher component pricing in future agreements.

Potential Impact on iPhone 18 Pricing

If Apple chooses not to fully absorb the rising costs, analysts believe the iPhone 18 series could see further retail price increases. This risk is amplified by rumors that Apple plans to equip upcoming flagship models with six-channel LPDDR5X memory, designed to boost on-device AI performance and multitasking efficiency.

While such upgrades would deliver tangible performance benefits, they also compound manufacturing costs at a time when memory pricing remains highly inflated.

Apple’s Strategy to Offset Rising Costs

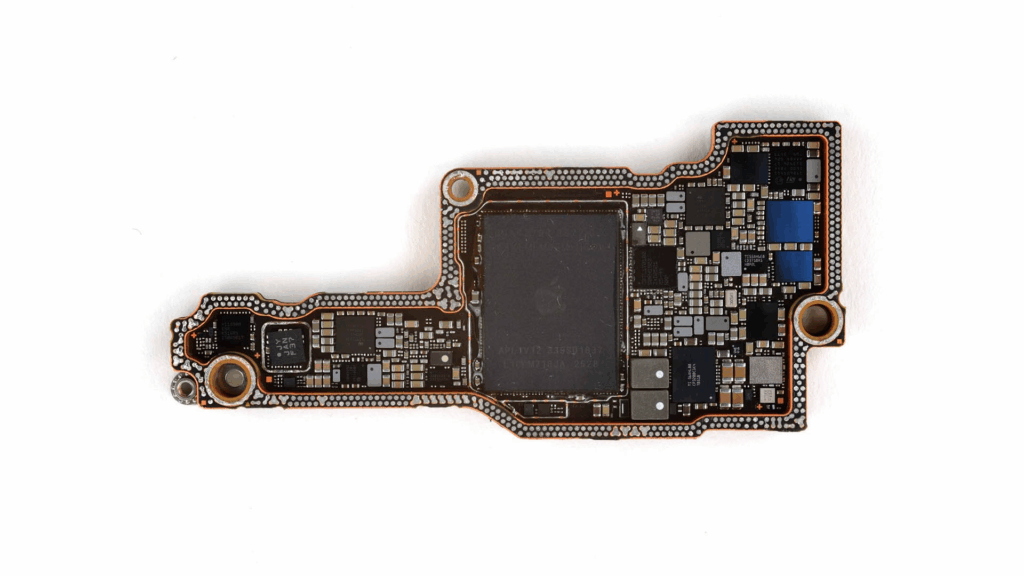

Apple is reportedly working to mitigate these pressures by expanding its reliance on in-house technologies. This includes the development of the A20 and A20 Pro chips, expected to be built on advanced 2nm manufacturing processes, as well as a new C2 5G modem slated for future flagship iPhones.

By reducing dependence on third-party suppliers such as Qualcomm, Apple aims to regain greater control over long-term costs, though these efforts may not fully offset the near-term impact of memory price volatility.

A Long-Term Industry-Wide Challenge

Market analysts warn that the current DRAM shortage could persist until Q4 2027, suggesting the issue will affect not only Apple but the broader smartphone industry. Manufacturers worldwide may be forced to make difficult choices between reducing memory specifications or raising retail prices, all while navigating economic uncertainty and fierce competition.

As memory costs continue to rise, the coming years may redefine how flagship smartphones balance performance, pricing, and profitability.

Source: Wccftech