Square Enix Boosts Operating Profit Nearly 40% Despite Lower Sales

Square Enix Boosts Operating Profit Nearly 40% Despite Lower Sales

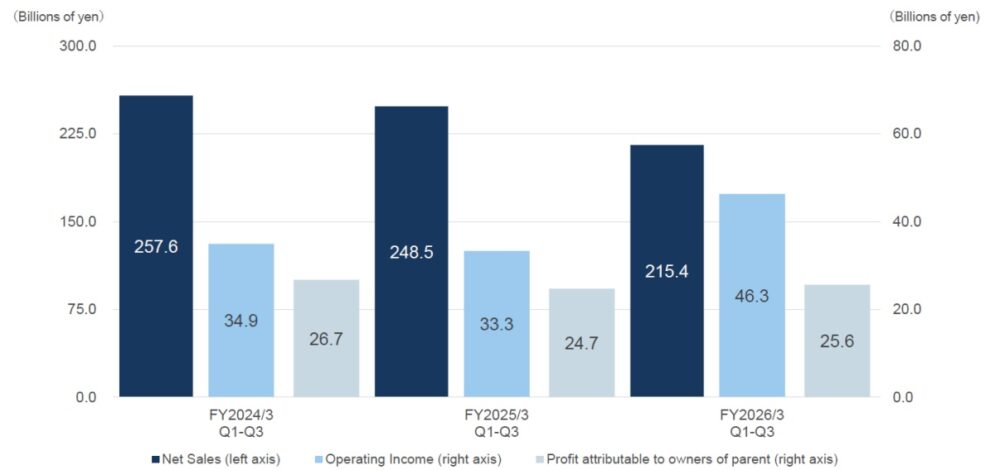

Square Enix, the renowned Japanese game company, has reported its financial results for the nine months spanning April 1, 2025, to December 31, 2025. While total revenue fell, the company achieved a remarkable increase in operating profit, demonstrating that lower sales do not necessarily equate to weaker financial performance.

Key Financial Highlights

- Net Sales: ¥215.4 billion (down ¥33.1 billion year-on-year)

- Operating Income: ¥46.3 billion (up ¥13.0 billion, nearly 40%)

- Profit Attributable to Owners: ¥25.6 billion (up ¥0.9 billion)

Performance by Business Segment

Digital Entertainment (Games):

Revenue decreased mainly due to lower game sales, dropping ¥38 billion. However, operating income grew by ¥7.6 billion, reflecting more efficient cost management and focus on high-performing IPs.

Amusement (Arcades & Prize Games):

Revenue remained relatively stable, but operating income rose thanks to existing branch performance and prize merchandise sales. This segment includes arcade machines, claw machines, gachapon, and related operations.

Publication:

Both revenue and profit declined slightly due to lower physical manga sales. Digital sales now account for 55% of total publication revenue.

Merchandising (Licensing & Merchandise):

This segment showed the strongest growth in both revenue and profit, driven largely by royalty income from core IPs.

Strategic Shift: Less Expansion, More Efficiency

Square Enix appears to have shifted its strategy toward quality over quantity. Fewer new IP releases were launched in 2025, but the company focused on revitalizing and re-releasing existing flagship titles such as Final Fantasy and Dragon Quest. By reducing expansion and improving operational efficiency, Square Enix successfully boosted overall profitability.

This approach underscores a trend in the game industry: optimizing existing assets and IPs can yield significant financial returns even when overall sales decline.